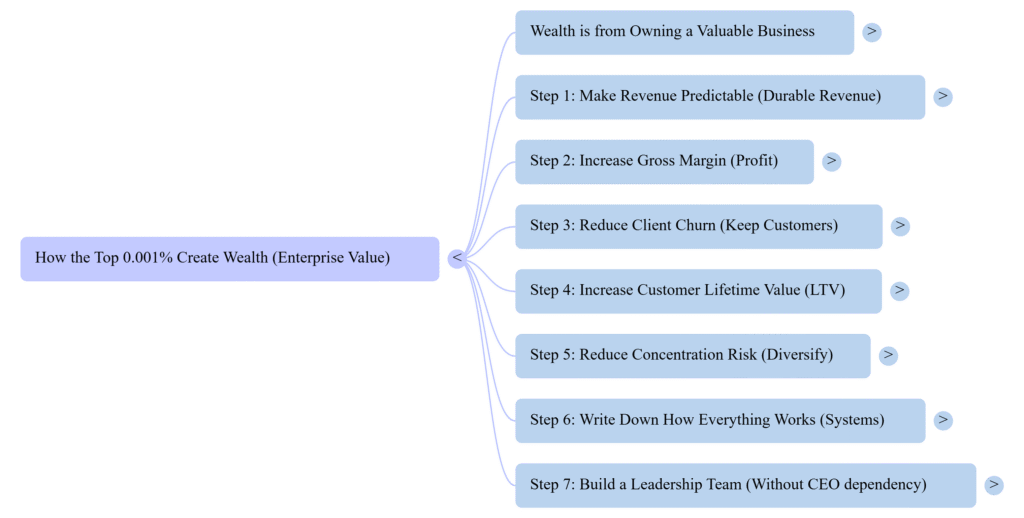

Have you ever wondered how the top 0.001% make money? It’s not from a salary. It’s not from investing. And it’s definitely not from real estate.

It’s from being a business owner.

I know this because I went from broke at 24 to selling my first company for millions at 28. Since then, I’ve built and sold multiple software companies and now own a portfolio on track to be worth a billion dollars in the next 3 years.

Most people think getting rich is about making a lot of money. When in reality, it’s about owning a business that’s worth a lot of money and knowing how to increase the enterprise value—which just means how much somebody’s willing to pay to buy your business.

And today, I’ll show you exactly how to do it, step-by-step.

Step 1: Make Your Revenue Predictable

This is kind of simple, but buyers will pay top dollar when they can count on your income, meaning that your revenue becomes predictable and durable. That’s the language.

When they look at the trailing 12 and trailing 24 months of your business and it just keeps going sideways or, ideally, up, a buyer is going to pay more for that kind of business because they can predict in the future it’ll keep doing the same thing.

Just think about your phone bill. It’s why telecom companies are worth so much money—because you pay the same every month.

And look, when I share this, some people are like, “Well, I don’t have recurring revenue.” But check it out: My brother’s a home builder. He started selling lawn care and snow removal as a contract to the people that bought homes from him. My buddy Nick owns a sign company. He started selling maintenance contracts.

I sell software. Guess what? Subscription revenue is a beautiful thing, but every business has the opportunity to build recurring, predictable revenue. You just got to be creative. Ask ChatGPT; it’s right there. This is what the money people call durable revenue.

Step 2: Make More Money on the Stuff You Sell

Durable revenue is great, but what makes businesses thrive is making profit on that revenue. The money people will call this gross margin. It’s the money you keep after you’ve paid for the cost of the service or the product.

My kids sell lemonade, and they will take your credit card and swipe it on their Square device. They will charge you two bucks for that glass. They only paid 25 cents for all the stuff that goes into it, from the cup to the lemon to the freaking ice cubes and stuff. So that means that they make $1.75 of gross margin.

See, the best companies focus on increasing their gross margin. Everything is around a conversation to do that, because the more you get on gross margin, the more profit you have left over.

So here’s how you can increase your gross margin:

Decrease Your Costs

For example, if you look at AI and automation, many service businesses could automate a lot of their back-office costs—their people—to deliver the service to make it even better from a gross margin point of view. If you buy things that are part of what you sell, you can go find a different supplier, maybe negotiate higher volume for a lower cost. All of that hits the bottom line from a gross margin point of view.

Increase Your Price

This is literally the go-to move. If somebody bought your business tomorrow, the first thing they would change is your prices. You can pretty much increase your prices until you notice your sales conversion drop a little bit.

And I get it, if you raise your prices, less people will buy. But people will buy if you market properly, if you build the brand properly, if you deliver a quality product or service. Trust me, the problem is not that people won’t buy; it’s that you haven’t built enough demand to overcome putting your prices up.

Drop the Unprofitable Clients

And this one is going to sting and could be quite scary. A big piece of advice is that you drop the unprofitable clients. Again, if somebody bought your business tomorrow, they would probably fire the lower 10% of your clients that aren’t profitable. The ones you gave early deals to, the people that complain all the time, the ones that are outside your target market today but you kept them around… they’re not really making you money, but you feel bad for firing them. They got to go.

The easiest way to fire them is just put your prices up to a point where they don’t like it, and then they just self-select.

This is why it’s so important to increase your gross margin. First off, you make more money, so you have more money to grow. And second, people that buy your business are going to be more excited because you have more profit. You’re more attractive to other buyers, which creates more demand to buy your business, which means the price goes up.

Everybody looks at revenue as how cool a business is, how much money they make. But to me:

- Revenue is just vanity.

- Profit is sanity. (It keeps the lights on.)

- But EBITDA is value.

Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA) is a fancy word that buyers will look at because the bigger your EBITDA, the more they’re willing to pay you on multiples. But what a lot of people don’t know about making your business more valuable is that profits die if you have customers leaving through the back door.

Step 3: Reduce Your Client Churn

So what do you do? Essentially, keep the clients you got.

If you have a bucket and there are massive holes in the bucket, and your customers are water being poured at the top, the water flowing out is your customers churning. That means the bucket will never fill up. If the bucket’s not full, there’s no value. Nobody’s going to buy you ’cause it’s an empty bucket.

Why businesses don’t understand this is because they can’t see it. They don’t track it. I’ve got 100 clients this month, 100 clients next month. They don’t go, “Oh, we lost one. We lost two. We lost three.” Over time, that number could be massive. Most businesses are losing 100% of their customers every 10 months. They just don’t know it.

And the truth is, high churn—10-15% a month—kills a company’s worth. Nobody’s going to buy a business if you don’t have predictability in the customers buying and continuing to show up.

Imagine I had a grocery store. For the first few years, I had a lot of people buy and my revenues were good, but nobody paid attention that the population around the grocery store wasn’t coming back. They came in and they didn’t have a certain product, or they bought something and it wasn’t great. Eventually, I burned through the whole population, and then I go to sell my business, but I’m slowly dwindling down my revenue because I don’t have anybody else to sell groceries to.

The more customers you keep, the more profits will stack because each customer’s gross margin stacked up over time creates more profit at the bottom.

So here’s how we actually reduce your churn.

Track Your Monthly Recurring Revenue

First, we got to track monthly recurring revenue. Essentially, we need to look at the trend closely so we know where the leaking is happening. This will make sure you catch churn. Most people just don’t even measure it. So measuring that monthly recurring revenue from the existing customers will show you that.

If you know this, then you can measure what’s called your growth ceiling—a point into the future when you will stop growing based on your current numbers. If that sounds like Chinese to you, I’ll make it simple. Click the link in the description below to download my Growth Ceiling Calculator. I’ll ask you four questions, those four numbers, and it will predict exactly when you will hit your growth ceiling and what to focus on to fix it.

Get Customers to Value as Fast as Possible

So now that you know who’s churning, the way to fix it is very simple. You have to get your customers to value as fast as possible. I call this Time to First Value (TTFV). Ideally within 7 days, but honestly, I call them quick wins. I want to do it in the first interaction. If you sell social media stuff, give them a cheat sheet that they can use tomorrow shooting their Reels. It got them a result; it got them value.

Implement a Cancellation Capture Flow

And last but not least, we need to implement a cancellation capture flow. Every customer that leaves is leaving with information—feedback to make your business better. If they leave without you capturing that information, you’re missing the opportunity to learn. The speed of growth to make your business valuable is the speed of learning.

So remember:

- We got to track so we see the trend.

- We got to get them to value fast.

- We have to make sure if they leave, we know why.

Step 4: Increase the Amount of Money Your Customers Pay You Over Time

Okay, so now that the bucket isn’t leaking, let’s make sure we make more money from those existing customers.

The money people in the industry, they call this Lifetime Value (LTV) of a customer. Essentially, if somebody buys from me once and they keep buying from me over a period of time, I’m going to look on average what a customer spends with me. That becomes the lifetime value of a customer.

The reason we want to know this is because a buyer that wants to value your business is going to look at how much you spend to acquire a new customer. If that number is low (what you spend to get the customer) and what you make is high, then that is a very good business to buy.

Have you ever wondered why Netflix is worth $521 billion? It’s because they have subscriptions, and over time, their customers actually spend more money. Netflix figured out, “Hey, I could charge more,” and “If we stop people sharing their accounts with everybody, their cousins, and their dogs, then I can get those people to pay.” That’s why Netflix has grown their subscription base and the lifetime value of a single account.

So here’s how you can increase the lifetime value of a customer.

Add Upsells and Usage-Based Pricing

First, add other things that they buy or give them a reason to upgrade. You might be giving too much away to your existing customers and you have to create reasons for them to want to upgrade. Look at what everybody’s using on average and just create some parameters around their usage so they have upgrade paths. If they’re getting more value, they should be paying more for it.

Monetize Additional Services

Then, we want to monetize additional services. Ask yourself, what does my customer do 3 minutes before and 3 minutes after they use my product or service? Those are opportunities for me to monetize additional services. If you have a gym, maybe you sell clothes, or maybe you should have a smoothie bar.

Create Expansion Triggers

Last, look at ways to create expansion triggers in your customer journey. This means that there’s something they do that tells you there’s an opportunity for you to sell them more. Think about Dropbox. When you get to 80% of your storage usage, they’ll email you saying, “Hey, you’re at 80%. Did you want to upgrade for a discount to get triple the storage?” Those are expansion triggers.

A company that grows the amount of money they make from their existing customer base over time—without adding any new customers—becomes incredibly valuable to a buyer. This turns your business into an annuity. A buyer will feel better because they’re not going to be pressured to have to add new people if you’re not able to make more money with the ones you have.

Step 5: Don’t Put All Your Eggs in One Basket

With that in mind, the next step is crucial if you want to grow your company’s worth. This is what the money people call concentration risk.

For example, if you rely on one big customer for 60% of your revenue, that’s concentration risk. If you rely on one or two partners to generate all the marketing and sales for your business, incredibly dangerous. Concentration risk isn’t just about how you get your money; it’s about where your leads come from, how you deliver that service, or where you even get the supplies.

So here’s what you need to do to lower that concentration risk.

Diversify Your Client Base

First thing is you got to keep your top clients under 15% of your revenue. Ideally, your top three customers shouldn’t be more than 30% of your total revenue.

Diversify Your Marketing Channels

In my world, I don’t want any one marketing channel to be more than 40% of my lead generation. I have a business, and at one point, Instagram was 85% of our lead generation. I went to the CEO and I said, “We’ve got 6 months to bring that down below 40%.” And he did. That way, if something happened to my Instagram, we didn’t skip a beat.

The reason why this is important is because diversification makes your business safer to run. It takes that single point of failure away, and that’s what buyers are looking for: safety in your operations.

Step 6: Write Down How Everything Works

Now that we’re in a safer position, let’s clean up the way you run your business.

Some people call these standard operating procedures (SOPs). Other people call them checklists or systems. I like the analogy of playbooks. Essentially, I want a playbook for every department in my company that explains exactly how we operate.

If you don’t have them written down, then a buyer won’t trust that they’re going to be able to take the business from you and operate it because there’s nothing documented. You have to make it easy for somebody to come in cold, go through your playbooks, and understand exactly how you make your secret sauce.

McDonald’s can open a store in Japan and have a 14-year-old kid make a Big Mac that tastes exactly the same as the one I bought in New York City. How crazy is that? Why? They have a playbook.

So here’s a simple way for how you can build your playbooks.

First, I call it the camcorder method. I want to record myself doing the task. While I’m doing it, I’m recording myself and talking out loud about what I’m doing and how I’m doing it. The cool part is then I can use a free tool like Trainual, which will use AI to create the playbook from the video.

Then we have to store that document into some kind of company wiki. You can use Trainual, Google Docs, or Notion, but you got to put it in an organized fashion. Why does this increase the worth of your business? Because a well-documented business is easier to scale, grow, and sell.

Step 7: Build a Leadership Team

Once you do that, now you can move to the most important step of the process. A leadership team is one of my favorite things to build because it’s a team that runs the company without you making every decision.

I know this is scary. “What do you mean, what’s my job as a CEO if I’m not making all the decisions?” Well, let me tell you: One is vision, two is money, and third is people.

Your job is to pick these folks. The better you do at picking the leadership team, the more valuable the company gets because a buyer is going to interview them. If they find a bunch of ding-dongs, you’re not going to get bought for a lot of money.

Here’s how you actually build a leadership team.

Empower Your Team

One of the first things you have to do is empower your team to run the show. Steve Jobs used to say, “It’s easy to hire somebody and tell them what to do. It’s hard to hire somebody and have them tell you what to do.” I give them the keys, the ownership, the responsibility.

Hire Key Roles

Start by hiring somebody to help run operations. At the end of the day, you’re probably best at doing marketing and sales. Having somebody start to manage operations—finance, recruiting, technology—is key.

Create a Dashboard

Next, you want to create a dashboard—a simple, clear way to track their results every day, every week, every month. The right way is to have them self-report and update that dashboard. You sit back and you coach and correct, but you’re not running or driving things.

Provide a Decision Framework

You need to provide a decision framework for those leaders to operate within. For example, in my business, I have a $50 rule for anybody to solve a problem, $500 for managers, $5,000 for directors, and $50,000 for C-level leaders where they can fix anything without approval. This pushes the decision to fix problems down to the people that have the most information.

Hold a Weekly Leadership Meeting

And then last, but definitely not least, on a weekly basis, you have to hold a leadership meeting. That way you can align everybody to the vision of the business and help them solve problems.

All of this is wildly important because you produce strong leaders that reduce the risk to a buyer and even free up your time to focus on growth. Buyers value companies with proven leaders already in place.

Conclusion: Building Real Wealth

I just gave you a masterclass in creating real wealth—how the 0.001% of people actually make their money by owning a business that’s valuable to somebody else.

It can feel like a lot, I get it. But I’m going to encourage you to consider this: Follow the steps. Look at what areas in your business are missing and just choose for the next 90 days to fix one of those. If you do that every 90 days over time, maybe in a year, you’ll build a business that’s incredibly valuable.

See, your active income—how much you make every month—is money. That’s cool. What’s creating the most value, though, is what’s called enterprise value. And it’s the value of the asset called your business to somebody who’s willing to buy it. That’ll make you rich.

And remember, if you want access to my Growth Ceiling Calculator, just click the link below and I’ll send it over to you. Now, if you want to learn how to build a business that runs itself, click the article and I’ll see you on the other side.